Commentaries

What the heck is going on with the stock market?

- September 29, 2011

- By Bob Dreizler

Last Friday the Standard & Poor’s 500 Index closed at 1136. A year ago it closed at 1134. In the mean time, this index of the 500 largest stocks rose 20% to 1360 in May before declining. Long-term, buy-and-hold investors broke even despite occasional massive daily swings of 2 to 3%.

So, somebody is making money. If I had to guess who, I’d start with the nice folks that brought us the Crash of 2008. They were never really punished for the schemes and scams that nearly collapsed the world economy, so they are back at work.

I don’t like to equate the stock market with a casino, but there are some similarities. I used to tell clients that historically the small investor was on the same side of the table as the house or big investors. I’m not sure if this is true anymore.

When high frequency traders (HFTs, see description below) make money whether the market goes up or down, volatility becomes more important than buying a good company for the long term.

I’m concerned that the impact of HFTs and increased short selling (see below) are harming long-term investors. I’m not speaking with certifiable knowledge; it’s more of a gut feeling.

I know this commentary is geekier than usual, but you should know about these two of many factors that, I believe, are negatively impacting the stock market.

Usually, when I start feeling pessimistic about the stock market and things seem like they can only get worse, it’s been a sign that the stock market is about to turn around. Let’s hope so.

HIGH FREQUENCY TRADING (from Wikipedia)

High frequency trading (HFT) is the use of sophisticated technological tools to trade securities like stocks or options, and is typically characterized by several distinguishing features[1]:

HFT is highly quantitative, employing computerized algorithms to analyze incoming market data and implement proprietary trading strategies;

HFT usually implies a firm holds an investment position only for very brief periods of time – even just seconds – and rapidly trades into and out of those positions, sometimes thousands or tens of thousands of times a day;

HFT firms typically end a trading day with no net investment position in the securities they trade;

HFT operations are usually found in proprietary firms or on proprietary trading desks in larger, diversified firms;

HFT strategies are usually very sensitive to the processing speed of markets and of their own access to the market.

In high-frequency trading, programs analyze market data to capture trading opportunities that may open up for only a fraction of a second to several hours.[2]

High-frequency trading, (HFT), uses computer programs and sometimes specialised hardware [3] to hold short-term positions in equities, options, futures, ETFs, currencies, and other financial instruments that possess electronic trading capability.[4] High-frequency traders compete on a basis of speed with other high frequency traders, not long-term investors (who typically look for opportunities over a period of weeks, months, or years), and compete with each other for very small, consistent profits.[5]

SHORT SELLING (from Wikipedia)

In finance, short selling (also known as shorting or going short) is the practice of selling assets, usually securities, that have been borrowed from a third party (usually a broker) with the intention of buying identical assets back at a later date to return to that third party. The short seller hopes to profit from a decline in the price of the assets between the sale and the repurchase, as the seller will pay less to buy the assets than it received on selling them. The short seller will incur a loss if the price of the assets rises (as it will have to buy them at a higher price than it sold them), and there is no theoretical limit to the loss that can be incurred by a short seller. Other costs of shorting may include a fee for borrowing the assets and payment of any dividends paid on the borrowed assets. “Shorting” and “going short” also refer to entering into any derivative or other contract under which the investor similarly profits from a fall in the value of an asset. Mathematically, short selling is equivalent to buying a negative amount of the assets.

Short selling is almost always conducted with assets traded in public securities, commodities or currency markets, as on such markets the amount being made or lost can be monitored in real time and it is generally possible to buy back the borrowed assets whenever required. Because such assets are fungible, any assets of the same type bought on those markets can be used to return to the lender.

Going short can be contrasted with the more conventional practice of “going long”, whereby an investor profits from any increase in the price of the asset.

- Post Categories

- Uncategorized

Bob Dreizler

Where are my Photos and Art?

These two photos were exhibited in the 2018 California State Fair

AWARD OF EXCELLENCE AT 2016 CALIFORNIA STATE FAIR

Wooden Chair and Esalen Tree Photo (Illustration Mode)

Reflection in Lilly Pad Pond (Photo)

Tower Bridge with Moon (Photo)

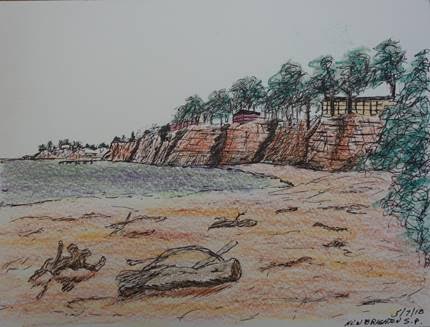

View from New Brighton Beach Campground Rollerball Pen and Colored Pencils

GRANNY, GRANDKIDS AND SEAGUL IN BODEGA BAY