Commentaries

The Unemployment Dilemma

- July 31, 2012

- By Bob Dreizler

The official unemployment rate has been hovering at about 8.2% during 2012, but it’s down from its recent peak 10.3% in October of 2009 (Source: National Conference of State Legislatures).

When you look at how the economy has evolved over the last twenty years, it is amazing that the rate isn’t higher. Consider these trends and events:

Technological advances have encouraged American companies to replace human employees with machines (bank tellers vs. ATMs).

Outsourcing of manufacturing jobs to poorer countries is a continuing trend.

Internet shopping has devastated not just local retail stores, but major corporations (book stores). As the dominant online sales company continues to expand its product line, it threatens other retail companies, big and small.

Internet services have reduced the need for human service providers (travel agents and financial advisors).

Government job reductions not only increase the unemployment rate, but it means that fewer workers will spend their money at private businesses. Think Furlough Fridays in Sacramento.

Consumers have never recovered from the economic disaster of 2008. People in the middle class are afraid to spend for discretionary items. At our art studio, sales have not come close to what they were before. While frugality is good, it doesn’t stimulate the economy.

Huge corporations continue to consolidate and merge. This reduces the number of mid-level jobs. As industries become oligopolies or virtual monopolies, employees with industry-specific skills are less able to bargain for good paying jobs.

Finally, the worldwide recession continues to drag on, reducing demand for American products.

As confidence in the economy grows, businesses and consumers will start to spend more. Job growth will increase and unemployment will decline, but due to fundamental shifts in the type of jobs available, the U.S. economy may never reach that magical “full” employment number again.

- Post Categories

- Uncategorized

Bob Dreizler

Where are my Photos and Art?

These two photos were exhibited in the 2018 California State Fair

AWARD OF EXCELLENCE AT 2016 CALIFORNIA STATE FAIR

Wooden Chair and Esalen Tree Photo (Illustration Mode)

Reflection in Lilly Pad Pond (Photo)

Tower Bridge with Moon (Photo)

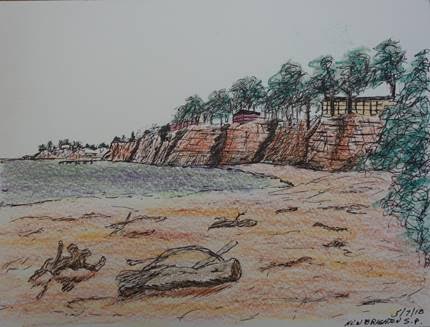

View from New Brighton Beach Campground Rollerball Pen and Colored Pencils

GRANNY, GRANDKIDS AND SEAGUL IN BODEGA BAY