Chartered Financial Consultant

Commentaries

Where are my Photos and Art?

FLOPPY'S DIGITAL COPIES (2031 J Street)

You can also see lots of them walking or driving by.

These two photos were exhibited in the 2018 California State Fair

AWARD OF EXCELLENCE AT 2016 CALIFORNIA STATE FAIR

Wooden Chair and Esalen Tree Photo (Illustration Mode)

Reflection in Lilly Pad Pond (Photo)

Tower Bridge with Moon (Photo)

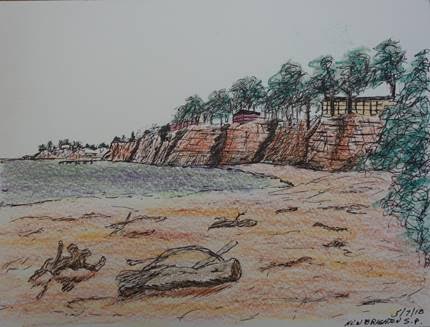

View from New Brighton Beach Campground Rollerball Pen and Colored Pencils

GRANNY, GRANDKIDS AND SEAGUL IN BODEGA BAY

Archives

Check the background of this investment professional on FINRA's BrokerCheck. © Copyright 2018 Bob Dreizler. All rights reserved Investment Advisory Services offered through Investment Advisor Representatives of Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer member. FINRA/SIPC, to residents of: CA, HI, MT, OR, NY, TX, WI, and WY. If you are not from one of these states, we will not attempt to transact securities, or provide personalized investment advice unless and until we are licensed in your state or international jurisdiction. This website and Bob's Latest Commentary newsletter are for educational purposes only and are not intended to contain recommendations or solicit sales on any specific investment. Opinions expressed in my newsletters and this website do not necessarily reflect the views of any other organization mentioned.

My Thoughts on the COVID-19 Stock Market #1

Perhaps you’ve noticed that the stock market has been a bit volatile lately. I‘ve noticed it too and thought you might want to know my thoughts. I’m writing this Sunday afternoon, March 15th. The S+P 500 Index* was up ten percent on Friday after the dropping over 20% in the previous two weeks. I expect a scary drop on Monday, but I could be wrong.

Note: This commentary will be delayed because I need to receive compliance approval before I can send it. Also, I will send my stock market/economy/whatever thoughts more frequently during the next few months. Feel free to reply directly to me.

I’ve been through a few of these dramatic stock market declines and they are always unnerving. The first one I remember was 1987. I was sitting in my office on El Camino Avenue listening to news reports of the stock market going lower and lower and lower—on my radio. There was no CNBC to hear experts explaining all day long.

I felt helpless then and I felt helpless now. However, suggesting that we all sell was not the right thing to do then. It wasn’t right before Y2K or after 9/11 or in 2001 as the tech bubble burst or during the long avalanche in 2007-2009. The stock market has always come back and reached new highs. When a meltdown is happening, it seems like the market will never rebound again. But what is most likely to happen in the future is what has happened in the past.

But there is always the thought, “Is it different this time?” Yes, and this time it’s not just about money, it’s about health and personal fear for ourselves and our loved ones. COVID-19 and the precautions related to it have already had a major impact on our livelihoods, our lifestyle and our state of mind. It is likely to get worse. There is a reverse trickle-down impact on everyone. Large events have been cancelled. Small restaurants closing. Investment accounts are declining. Most working people are losing income. These are certain to impact businesses and individuals for the near future.

Here’s my advice:

1) Call me if you need to talk. I’ll be in my office less frequently, so call my cell phone, if I’m not there. (916) 267-5112

2) It’s natural to be fearful, but don’t panic.

3) Determine if you need access to your money in the next two years or if these are long-term investments.

4) Remember that it is easier to get out of the market than to get back in. The immediate feeling of relief from reducing the volatility of your assets has a flip side. It prevents people from getting back into the market again, often forever. Those who fared the worst after 2007-9 were those who got out near the bottom and never got back in. The market climbed 300% during the next 10 years.

*It should be noted that the S+P 500 Index, which you cannot invest in directly, is made up of the largest 500 American companies. S+P is not the same thing as “the stock market.”

For perspective, below a list of my commentary headlines from mid-2007 to mid-2009. You can read any of these essays in the Commentary/Archive section of my website (bobdreizler.com).

July 12, 2007 S&P 500 Nears All-Time High!!!

October 19, 2007 Twentieth Anniversary of “Black Monday.”

March 19, 2008 Are We in a Recession?

July 15, 2008 Is the Economy Really Different this Time?

September 19, 2008 Bankers Gone Wild

October 15, 2008 Everything You Know is Wrong

November 13, 2008 Opportunities in a Declining Stock Market

December 23, 2008 Where’s the Bottom

March 2, 2009 Stock Market Sale 50% Off

April 20, 2009 It is Time to Open Your Investment Statements

May 26, 2009 How Quickly Attitudes Change

Please stay safe and healthy.

Bob

Bob Dreizler