Chartered Financial Consultant

Commentaries

Where are my Photos and Art?

FLOPPY'S DIGITAL COPIES (2031 J Street)

You can also see lots of them walking or driving by.

These two photos were exhibited in the 2018 California State Fair

AWARD OF EXCELLENCE AT 2016 CALIFORNIA STATE FAIR

Wooden Chair and Esalen Tree Photo (Illustration Mode)

Reflection in Lilly Pad Pond (Photo)

Tower Bridge with Moon (Photo)

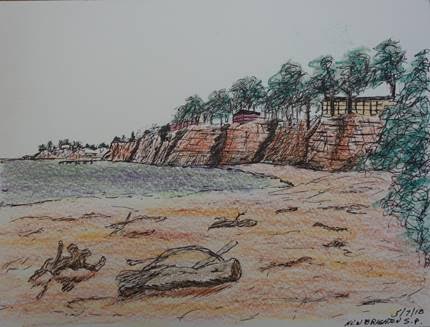

View from New Brighton Beach Campground Rollerball Pen and Colored Pencils

GRANNY, GRANDKIDS AND SEAGUL IN BODEGA BAY

Archives

Check the background of this investment professional on FINRA's BrokerCheck. © Copyright 2018 Bob Dreizler. All rights reserved Investment Advisory Services offered through Investment Advisor Representatives of Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer member. FINRA/SIPC, to residents of: CA, HI, MT, OR, NY, TX, WI, and WY. If you are not from one of these states, we will not attempt to transact securities, or provide personalized investment advice unless and until we are licensed in your state or international jurisdiction. This website and Bob's Latest Commentary newsletter are for educational purposes only and are not intended to contain recommendations or solicit sales on any specific investment. Opinions expressed in my newsletters and this website do not necessarily reflect the views of any other organization mentioned.

UPDATE: TRUMP’S DARN TAX LAW

Tax season is here. Ready? There were few new tax laws passed in 2019, but one is significant. As of January first of 2020, Required Minimum Distributions (RMD) from retirement plans must begin the year someone turns 72. Previously, RMDs generally had to start in the year someone turned 70 1/2.

2019 was the second full tax year since the Tax Cuts and Jobs Act (TCJA) was passed in late 2017, so we now know what the actual impacts of TCJA has been.

TCJA provided permanent massive tax cuts for corporations and the very rich. It also provided small temporary tax cuts for the rest of us. It took away some deductions and personal exemptions while increasing the standard deduction. IRS Code Section 199A reduced self-employment and rental income by up to 20%.

In early 2018 I predicted the follow impacts from TCJA. Unfortunately, most of my predictions were correct:

For those who dare read more, I’m including links to several articles. Read them if you dare.

Amazon will pay $0 in taxes on $11,200,000,000 in profit for 2018

https://finance.yahoo.com/news/amazon-taxes-zero-180337770.html

Under Trump’s tax bill, employees pay higher rates than biggest corporations in the world: Study

https://www.salon.com/2020/01/03/under-trumps-tax-bill-employees-pay-higher-rates-than-biggest-corporations-in-the-world-study/

Charitable Giving Took A Hit Due To Tax Reform

https://www.forbes.com/sites/nextavenue/2019/06/18/charitable-giving-took-a-hit-due-to-tax-reform/#9bbb9cf6ff65

Two Years Later, What Are Economists Saying about the Tax Cuts and Jobs Act?

https://www.pgpf.org/blog/2019/11/two-years-later-what-are-economists-saying-about-the-tax-cuts-and-jobs-act

A year after their tax cuts, how have corporations spent the windfall?

https://www.washingtonpost.com/business/economy/a-year-after-their-tax-cuts-how-have-corporations-spent-the-windfall/2018/12/14/e966d98e-fd73-11e8-ad40-cdfd0e0dd65a_story.html

All those share buybacks: What’s tax cuts got to do, got to do with it?

https://www.washingtonpost.com/news/posteverything/wp/2018/02/23/all-those-share-buybacks-whats-tax-cuts-got-to-do-got-to-do-with-it/

Mitch McConnell Calls for Social Security, Medicare, Medicaid Cuts After Passing Tax Cuts, Massive Defense Spending

https://www.newsweek.com/deficit-budget-tax-plan-social-security-medicaid-medicare-entitlement-1172941

Bob Dreizler