Chartered Financial Consultant

Commentaries

Happy Birthday Social Security

- August 2, 2015

- By Bob Dreizler

Social Security is about to celebrate its 80th birthday. Born in the heart of the Great Depression, it has survived wars, economic crises, social upheaval and Republican Presidential candidates. What would be the financial state of retired Americans if this program do not exist?

As workers transition from paying into Social Security to receiving monthly checks, it is a time for making crucial financial decisions. There probably is no more important time in an individual’s life to do financial planning than in their sixties.

This is a complicated system, but the most common Social Security decision concerns when to start benefits. Retirees can start receiving income benefits at age 62. At 66 (for those born before 1955), you can receive your “full” benefit without reduction or you continue to work. You can wait until age 70 and receive the maximum benefit. For each year you delay receiving benefits, your future monthly benefits would increase by 8% per year.

I’m about to turn 67. Yikes!! I thought I’d be collecting SS benefits by now but decided to wait. If I start at age 70, my monthly benefit will be 32% higher for life. Naturally, I could have received benefits now and invested them, but I thought a guaranteed 8% return was too good to compete with. If I live past 83 or so, I should be ahead.

Generally, it makes sense to wait if: 1) you don’t really need the additional money currently, 2) you are in good health, and 3) you have a family history of longevity.

If you are entering this transitional phase of your life, it might be worthwhile to schedule a consultation with your neighborhood financial consultant visit your local Social Security office, or check out http://www.ssa.gov/

- Post Categories

- Uncategorized

Bob Dreizler

Where are my Photos and Art?

FLOPPY'S DIGITAL COPIES (2031 J Street)

You can also see lots of them walking or driving by.

These two photos were exhibited in the 2018 California State Fair

AWARD OF EXCELLENCE AT 2016 CALIFORNIA STATE FAIR

Wooden Chair and Esalen Tree Photo (Illustration Mode)

Reflection in Lilly Pad Pond (Photo)

Tower Bridge with Moon (Photo)

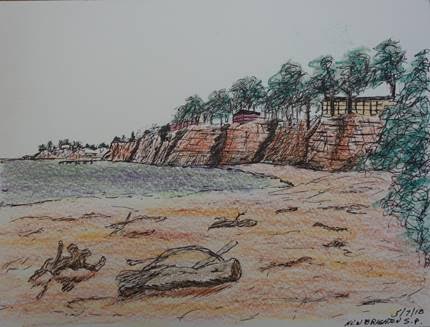

View from New Brighton Beach Campground Rollerball Pen and Colored Pencils

GRANNY, GRANDKIDS AND SEAGUL IN BODEGA BAY

Archives

Check the background of this investment professional on FINRA's BrokerCheck. © Copyright 2018 Bob Dreizler. All rights reserved Investment Advisory Services offered through Investment Advisor Representatives of Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer member. FINRA/SIPC, to residents of: CA, HI, MT, OR, NY, TX, WI, and WY. If you are not from one of these states, we will not attempt to transact securities, or provide personalized investment advice unless and until we are licensed in your state or international jurisdiction. This website and Bob's Latest Commentary newsletter are for educational purposes only and are not intended to contain recommendations or solicit sales on any specific investment. Opinions expressed in my newsletters and this website do not necessarily reflect the views of any other organization mentioned.