Chartered Financial Consultant

Commentaries

Time for a Correction?

- May 29, 2013

- By Bob Dreizler

“Correction” is a cute word that describes a stock market decline of 10-20%. This is a normal part of unpredictable stock market cycles. The good thing about corrections is that they only happen after the market has risen substantially.

That’s what the Standard and Poor’s 500 Index and the overall stock market has recently done. So far in 2013, the S&P has risen 14% with only two short 3% dips. Since January of 2012 the market is up 31% despite drops of 8% and 10%.

Just to remind those who call President Obama a “socialist,” since he took office in January of 2001, the S&P has doubled its value. The oil man from Texas who preceded him ended eight years in office with the S&P lower than when he took office in 2001.

I love it when the stock market is on a prolonged upswing. My clients’ accounts grow in value, though not as fast as the S&P since most accounts are well diversified, not 100% in large stocks that the S&P represents. Still, I get nervous when the market is this happy. A correction is sure to come; it’s just a matter of when and by how much.

What has amazed me most during the last year or two is that so many people are stillavoiding the stock market, having been severely traumatized by the corporate misbehavior of 2007 and 2008. This caused many to lose faith in the stock market, assuming it is a rigged game. It was hard not to come to that conclusion. The stock market is not fair, but what are the alternatives: gold, real estate, bonds, bank accounts, cash in a mattress? All these have their risks. “Safe” alternatives such as savings accounts and CDs pay just a fraction of 1% in interest while the buying power of that money shrinks due to inflation. The interest rate game is truly fixed because rates are set by the Federal Reserve.

Back to the coming correction. It might be caused by concern that stock prices are over-valued, having risen too high, too fast. Bad economic statistics, a tragic incident or a global political event could trigger this, too.

When the correction comes, remember what has happened lately. Don’t let it become an excuse to stay away from the stock market for years to come. The stock market will get happy again, just like it is as I write this.

- Post Categories

- Uncategorized

Bob Dreizler

Where are my Photos and Art?

FLOPPY'S DIGITAL COPIES (2031 J Street)

You can also see lots of them walking or driving by.

These two photos were exhibited in the 2018 California State Fair

AWARD OF EXCELLENCE AT 2016 CALIFORNIA STATE FAIR

Wooden Chair and Esalen Tree Photo (Illustration Mode)

Reflection in Lilly Pad Pond (Photo)

Tower Bridge with Moon (Photo)

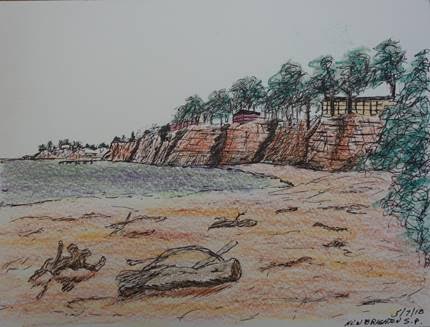

View from New Brighton Beach Campground Rollerball Pen and Colored Pencils

GRANNY, GRANDKIDS AND SEAGUL IN BODEGA BAY

Archives

Check the background of this investment professional on FINRA's BrokerCheck. © Copyright 2018 Bob Dreizler. All rights reserved Investment Advisory Services offered through Investment Advisor Representatives of Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer member. FINRA/SIPC, to residents of: CA, HI, MT, OR, NY, TX, WI, and WY. If you are not from one of these states, we will not attempt to transact securities, or provide personalized investment advice unless and until we are licensed in your state or international jurisdiction. This website and Bob's Latest Commentary newsletter are for educational purposes only and are not intended to contain recommendations or solicit sales on any specific investment. Opinions expressed in my newsletters and this website do not necessarily reflect the views of any other organization mentioned.