Commentaries

I Admit it; I’m a Deficit Geek (Warning: ranting ahead)

- December 17, 2010

- By Bob Dreizler

“Government debt is every politician’s dream: it gives him the ability to buy votes by spending on government programs (with funds raised through borrowing) that will make him popular now, while putting the lion’s share of the cost on future taxpayers, who must pay off the debt through taxes. It is the ultimate something-for-nothing scheme.”

– Hamilton’s Curse by Thomas J. Dilorenzo, Chapter 2

I’m a little embarrassed to admit that I’m a deficit geek. I have been since I was in high school and when I was a Young Republican during my first year of college. My political philosophy on many issues has changed since then, but I’m still a fiscal conservative on budget issues.

I wish Republicans were still conservatives, too, but Republicans aren’t fiscal conservatives anymore; they just use this issue when it suits them. When the federal budget deficit doubled with George W. Bush in power, there was nary a peep. Within months of President Obama’s inauguration, their talk-show PR squad started getting hysterical about fiscal irresponsibility. When the federal government spends money on health care, education and helping the poor, it’s flagrant spending. If it’s on wars, bribes to corrupt foreign leaders and enriching military contractors, that’s OK.

Their other solution is cutting taxes, particularly for the richest Americans. Anyone who manages a household budget knows that if you spend more than you earn, you have to do two things: cut spending and earn more money. If Representative John Boehner were a financial advisor, he’d suggest that you get out of debt by taking Thursdays off work. If Senator Mitch McConnell were a dietician, he’d suggest that the best way to lose weight is by eating more desserts.

Supply-side economics, as they are afraid to call it, has risen its head again. Candidate George H W Bush called this strategy, proposed by Ronald Reagan, “voodoo economics.” The myth is that when the economy turned around it was because of tax cuts. In actuality, it was because of a massive stimulus program for military spending. During Reagan’s eight years in office, revenues increased by 15% while federal spending increased by 25%, and federal debt grew from about $1 trillion to over 2.8 trillion, or 20% per year. That’s the shining example of “fiscal conservatism?”

During Clinton’s “high-tax-rate” years the debt increased by about 4% per year, and he ended his presidency with a surplus. George W. Bush nearly doubled the debt in the following eight years.

Republicans and President Obama just cut a deal to extend the 2001 and 2003 Bush tax cuts that particularly benefited the very rich. Supposedly this would creates jobs. Here’s what the Wall Street Journal said in January, 2009 about job creation during the Bush administration’s eight years in office:

“The Bush administration created about three million jobs (net) over its eight years, a fraction of the 23 million jobs created under President Bill Clinton’s administration and only slightly better than President George H.W. Bush did in his four years in office.”

http://blogs.wsj.com/economics/2009/01/09/bush-on-jobs-the-worst-track-record-on-record/

So, if these tax cuts didn’t create many jobs during the last nine years, why should they work now?

This attitude of “we’ll fix the deficit next time” makes me crazy. Most Congressional Republicans are hypocrites and most Democrats are spineless. Something needs to be done–soon.

If you are interested in learning more about budget issues and how the federal government is really spending tax dollars and borrowed funds (I bet you can’t wait) here are some interesting links from a variety of organizations:

http://www.brillig.com/debt_clock/

http://nationalpriorities.org/

http://www.warresisters.org/pages/piechart.htm

http://www.heritage.org/budgetchartbook/

http://www.concordcoalition.org/

http://en.wikipedia.org/wiki/File:US_Federal_Debt_as_Percent_of_GDP_by_President.png

- Post Categories

- Uncategorized

Bob Dreizler

Where are my Photos and Art?

These two photos were exhibited in the 2018 California State Fair

AWARD OF EXCELLENCE AT 2016 CALIFORNIA STATE FAIR

Wooden Chair and Esalen Tree Photo (Illustration Mode)

Reflection in Lilly Pad Pond (Photo)

Tower Bridge with Moon (Photo)

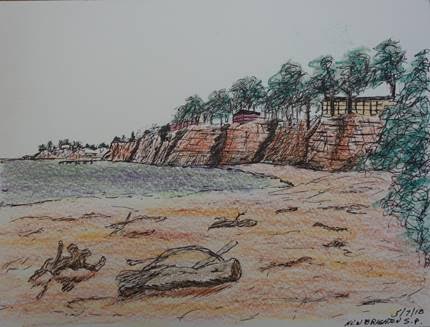

View from New Brighton Beach Campground Rollerball Pen and Colored Pencils

GRANNY, GRANDKIDS AND SEAGUL IN BODEGA BAY